Good return during a turbulent year

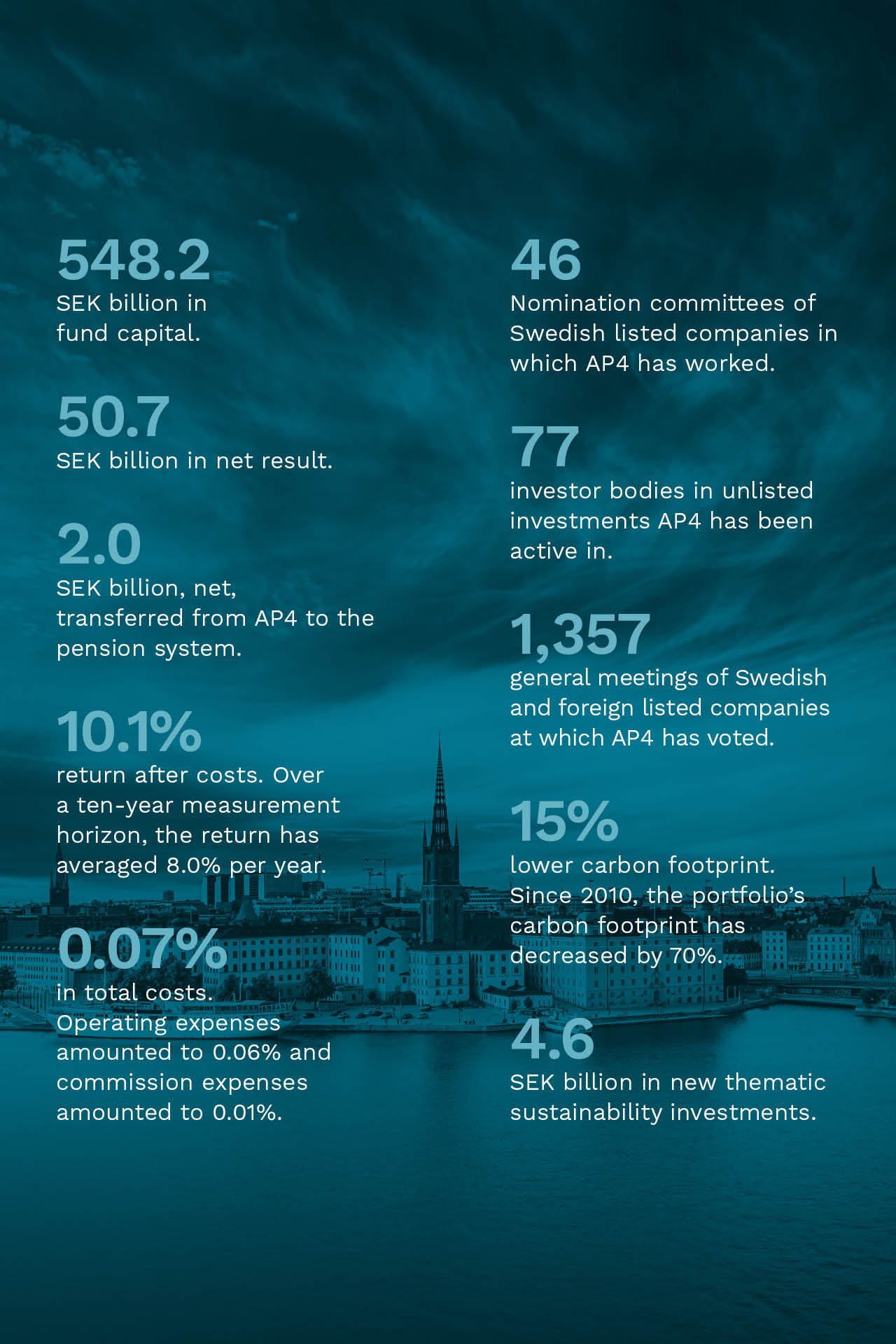

2024 gave a good return for AP4 of 10.1 percent and a result of SEK 50.7 billion. Fund capital increased to SEK 548.2 billion.

Our asset management is long-term with the aim of managing the fund capital to the greatest possible benefit for the income pension system and to contribute to financial security for today's and tomorrow's pensioners. Our focus on innovation, transparency and sustainability strengthens our position as a key player in the Swedish pension system. At the start of the new pension system in 2001, AP4's initial fund capital was SEK 134 billion. From its inception in 2001 until 2024, AP4 has paid out a net SEK 70 billion to the pension system.

AP4 conducts cost-effective management, as shown by the international comparison conducted annually by CEM Benchmarking. In the 2023 survey, AP4's cost level was just over 30 percent lower than that of comparable pension funds. The lower cost level is due to a number of factors. AP4 has sufficient fund capital to conduct cost-effective management and has deliberately chosen an asset allocation with a focus on asset classes that are less costly to manage. The lower cost level is also due to the fact that AP4 has chosen a larger share of cost-effective internal management than the peer group. AP4 also pays lower management fees for corresponding external management assignments than the peer group.

Asset allocation and management

In order to concretize AP4's long-term mission to deliver high returns, AP4 conducts an analysis of the pension system's needs every three years, a so-called Asset Liability Management Analysis (ALM). The aim is to strive for the balance between expected return and risk that best contributes to the long-term strengthening of the pension system. Based on the analysis, AP4's long-term return targets are determined as well as long-term appropriate intervals for equity shares, currency exposure and the average duration of interest-bearing investments (fixed interest period).

The most recent ALM analysis was conducted in 2023 with the conclusion that the appropriate range for AP4's equity portion was kept unchanged at 50–70 percent of the fund capital. The ranges for currency exposure and the average duration of the fixed income portfolio were also kept unchanged at 20–40 per cent and 3–9 years, respectively.

AP4 invests in most asset classes in order to have the prerequisites to achieve the return target over time. AP4's asset classes are listed equities, divided into Swedish, global and defensive, Swedish and global fixed income, and real assets, as shown in the chart below.

Thematic sustainability investments

AP4 continuously analyses sustainability trends in various sectors and actively seeks investments that are deemed to contribute to and benefit from the transition to a sustainable society. The goal is to make good investments from both a sustainability and a financial perspective.

These investments, which AP4 refers to as thematic investments, are based on an analysis that identifies which value chains are affected and thus expected to be winners and losers in the global sustainability transition. The analysis identifies investment themes that cover approximately 90 percent of global greenhouse gas emissions. These investment themes are distributed across the investments made in 2024, as the chart below shows.